Bankruptcy & Taxes: What You Need to Know

- Posted by Joshua Sells

- On January 24, 2022

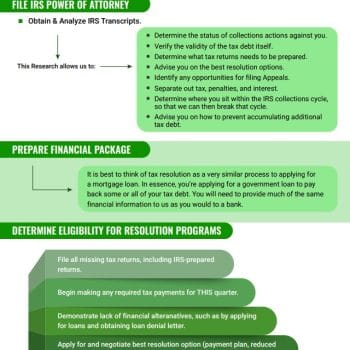

How exactly does IRS tax resolution work for a taxpayer with back tax?

IRS Tax Resolution

Bankruptcy is a taboo subject of discussion in our society, despite the fact that it’s a perfectly legitimate tool for flushing debts and starting over financially. When your client is deep in the hole with credit card debt, medical debt, mortgage debt, and the like, bankruptcy can be a lifesaver.

Even student loan debt can be discharged in bankruptcy in limited circumstances, which comes as a shock to most people.

But what about tax debt? That’s money owed to the IRS, so that obviously cannot be discharged in bankruptcy, right? Hmm, not so fast!

Let’s talk about Terry.

Terry is a 45 year old divorced father of three. The last couple years have been financially difficult, as it has for millions of Americans. Terry was laid off from his job as a restaurant manager in early 2020, and unemployment just wasn’t enough to keep paying the mortgage, the car payment, the credit card bills, and still put food on the table.

Oh, and let’s not forget about the $34,000 IRS tax bill from a few years back.

Terry is in such a bad spot financially, that he decides to speak with a bankruptcy attorney and find out what his options are. I met Terry because that bankruptcy attorney brought me in to discuss the tax side of the situation.

During my conversation with Terry and the bankruptcy attorney, I asked some questions about the tax debt.

The first thing we discussed was what type of tax debt it was. There was no business tax debt involved here. No issues stemming from unpaid payroll taxes or anything like that. Just regular old personal income taxes from a 1040 return. This was a good start.

Next, we talked about the timeline of his tax return. Terry handed me a copy of the tax return in question, which was for tax year 2017. This was another good sign, because the tax year in question is now more than three years old.

Terry then gave me permission to obtain copies of his IRS account records for the past several years. From that research, I was able to determine that Terry filed this tax return a little bit late. It was due in April 2018, but he didn’t file until a year later, in April 2019. But that’s OK, because it was still filed more than two years ago.

I then had to look for any further IRS actions against Terry for this tax return. They did audit this tax return in 2020, and they did bill him for some extra tax. That extra tax was tacked on last summer, and the audit closed out. Since last summer was more than 240 days ago, Terry is also in luck.

Since Terry owes no other tax debt besides this one year, and he meets the three timing rules, Terry is in a good position to potentially have this IRS debt included in his bankruptcy. There’s some additional work to be done, but at least Terry meets the all-important legal barrier of these timing tests.

This clearly isn’t one of those things that you want to tackle by yourself for your clients. If your client owes back taxes to the IRS, and he is already speaking with a bankruptcy attorney, then the three of us – you, your bankruptcy lawyer, and myself (the tax lawyer) – should have a conversation. Your client’s tax debts might already be dischargeable in bankruptcy, or your client might be able to delay his bankruptcy filing in order to meet the timelines necessary to make them dischargeable. Either way, this requires advance planning involving both tax advisers and the bankruptcy attorney.

0 Comments