IRS Balance Due Notices: CP504 vs CP90

- Posted by Joshua Sells

- On January 21, 2022

What's the Difference between the CP504 and the CP90?

IRS Balance Due Notices

When a taxpayer has a balance due, the IRS will generally send five letters about five weeks apart.

- CP14 Notice of Unpaid Taxes

- CP501 Reminder of Unpaid Taxes

- CP503 Second Reminder of Unpaid Taxes

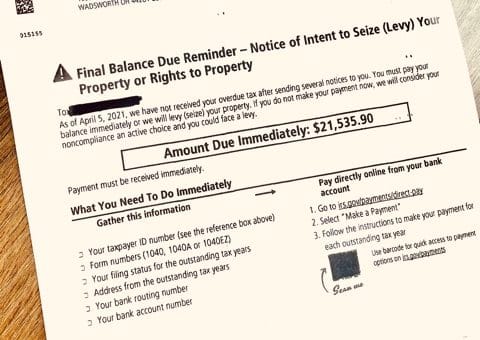

- CP504 Notice of Intent to Levy

- Letter 1058 (or LT 11 or CP90) Final Notice of Intent to Levy and Notice of Rights to Appeal

The first three notices are generally considered “warning shots.” These are just the billing notices and formal requests for payment. However, when the CP504 Notice of Intent to Levy comes, the IRS is now turning up the heat.

CP504 Notice of Intent to Levy

I.R.C. Section 6331 (d) requires the IRS to give notice that the IRS intends to take a taxpayer’s assets (wages, tax refunds, balances in bank accounts, etc.). The CP504 does just that. At this point, any state refunds a taxpayer may be entitled to are up for grabs by the IRS. The taxpayer does not have formal appeal rights at this point of the juncture, but the IRS has put the taxpayer on notice that it is getting real.

Letter 1058 or CP90

This is the last of the statutorily required notices. The IRS is giving the taxpayer 30 days to file a Collection Due Process (“CDP”) hearing. After 30 days, the taxpayer loses these valuable appeal rights. Although an “Equivalent” hearing may be requested, only a timely CDP hearing request will stop collection in their tracks.

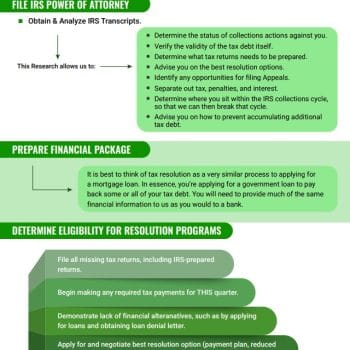

If the taxpayer has received either a CP504, or the 1050/CP90, it is imperative to discuss with a tax attorney regarding next steps. The IRS Independent Office of Appeals is the taxpayer’s “BFF” and will work with the taxpayer way more than collections. The only way to get into appeals, however, is through those CDP rights.

The rule of thumb with IRS notices – deadlines matter. Pay close attention to the letters and notices that a taxpayer receives.

0 Comments